Administrators of Barbados entered 2020 in a happy New Year mode following multiple pieces of good financial news in December with the latest being an International Monetary Fund’s further approval of the way they are restructuring the economy.

On the heels of a series of international credit rating upgrades earlier last month came news that the IMF has again stated its happiness with the way government is managing an economic recovery and transformation programme.

IMF Deputy Managing Director, Tao Zhang, stated, “Barbados continues to make good progress in implementing its comprehensive homegrown economic reform program. All quantitative performance criteria, indicative targets, and all structural benchmarks for end-September 2019 were met.”

“The fiscal adjustment continues as programmed with the primary surplus targeted at six percent of GDP for FY [financial year] 2019/20 and subsequent years. This target for end-September 2019 was met by a significant margin, and the FY2019/20 budget provides a solid basis for reaching the target for the next fiscal year.”

With this statement, IMF announced that it is freeing-up for Barbados $48 million, which is another tranche in a total $288 million special interest rate loan.

Since government and the IMF signed the four-year agreement in October, Barbados drew down a total of $145 million [including the December portion] in tranches based on periodical assessments of the island’s performance under a Barbados Economic Recovery and Transformation (BERT) programme.

Earlier in the month, New York-based international financial rating agency, Standard and Poor’s, raised Barbados’ credit rating six notches from to ‘‘B-/B’ from ‘SD/SD’ (selective default)’. And one week prior, Trinidad-based regional financial rating agency, CariCRIS, removed its CariD (Default) Regional Scale Foreign Currency Rating of the government of Barbados and assigned an upward rating of a CariBB-, with a stable outlook.

These international credit rating upgrades are the first the island has had in 11 years, following 22 consecutive downgrades that ended in 2018 when government embarked on the BERT programme and began renegotiating with creditors for new arrangements for payment of outstanding debt.

Similar to the impact of greater credit worthiness felt with the halt in downgrades, the collaboration programme with the IMF has the Barbadian government feeling much more secure in its foreign reserves standing that has moved from a perilously low amount of $220 million in 2018 to $650 million.

Unlike structural reforms in economies of other countries in IMF agreements where there are accusations that welfare of the people is neglected, the Barbados transformation programme fully considers the wellbeing of citizenry.

This IMF’s Zhang noted in his statement, “adequate social spending and an improved safety net to protect the most vulnerable members of society are key priorities of the program. Social spending is being protected, preserving Barbados’ strong social safety net and limiting the impact of the stabilization program on low-income households.”

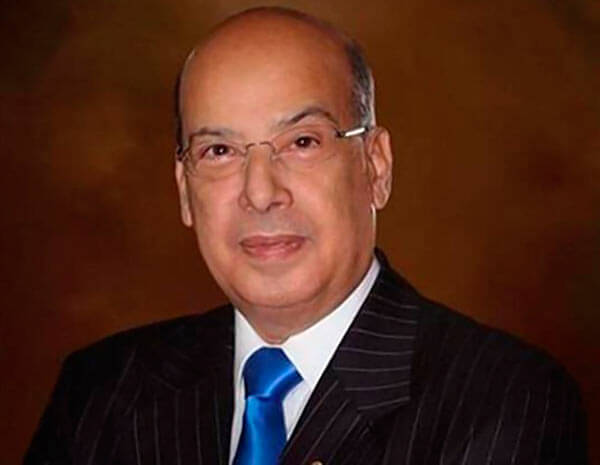

A government advisor behind debt renegotiations that led to the halt in downgrades and continued IMF approval, Professor Avinash Persaud, said that with the encouraging signs of an economic turnaround, businesses are again showing keep interest in the island.

Local newspapers quoted him speaking of, “a marked increase in the number of investors who themselves are saying to us that the investment climate has fundamentally changed. I think this confluence of the rating improvement, the surpassing of the BERT targets in the second review and the continuing climb in reserves, marks an important inflection point as we move from stabilisation to recovery and onto transformation.”